Q3 2024 Edmonton CRE Market Overview

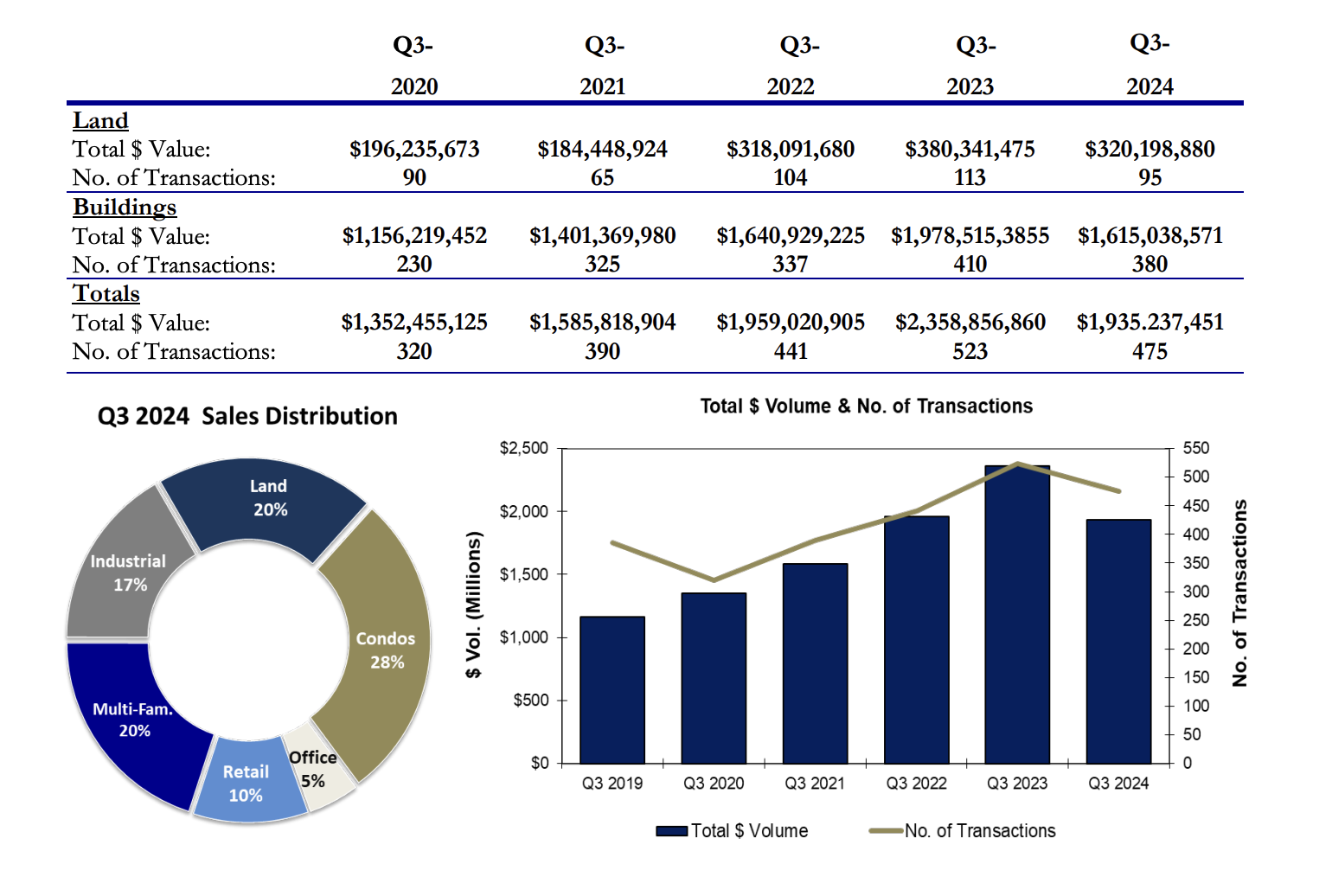

Continuing the trend that began in Q1 of this year, commercial real estate investors in the Edmonton market maintained their slower pace of acquisitions through the third quarter of 2024. From July through September, 156 transactions closed, adding $741.2 million of property and land sales to the year-to-date total. Compared to Q3 2023, investment was up in just two of the six asset classes we track with multi-family property sales leaping and garnering an additional $63 million in total dollar volume. Commercial office assets once again posted a year-over-year gain, rising by $25 million - albeit on a reduced number of sales.

At September 30th, the remaining asset types we track had generally returned to Q3 2022 levels with the lone exception being industrial properties. The latter posted the most notable decrease in both year-to-date transactions and dollar volume, such that total investment was similar to Q3 2020 levels. Commercial condominium investment continued to show signs of softening after several consecutive years of strong sales, and despite a third-quarter resurgence in retail property sales, investment in that asset type remained muted in comparison to the previous four years. Land sales remained within a narrow post-pandemic band of total transactions and dollar volume.

After bottoming-out in 2019, dollar volume invested in commercial office assets remained on an upward path and reached a new multi-year Q3 peak. Three office building transactions closed during the third quarter, contributing just under $37 million to the September 30th total of $115.2 million. While total year-to-date sales numbers were down slightly versus the year before, the lack thereof was made up for by several large transactions of $8 million and greater.

The Downtown submarket proved substantially busier through 2024 than last year, with four properties changing hands compared to just one at the same point of 2023. These four building contributed nearly half of year-to-date dollar volume, with the most significant of them being Sun Life Place which sold for $33 million (11.5% cap).

MULTI-FAMILY SECTOR

Investment in multi-family properties continued its steep upward trajectory, increasing by $396 million in just the third quarter of 2024 alone. This three-month period contained six big-ticket transactions of $25 million and greater and is the main reason why multi-family investment was by far the largest source of commercial investment in Edmonton at September 30th. As noted in the chart below, sales activity and dollar volume reached all-time records of $906 million over 95 transactions.

The largest transaction of Q3 2024 was the $79.3 million purchase of The View (4.3% cap). The property moved for $443,000/suite - the highest price per door seen so far this year. The largest multi-family asset purchase of the year so far remains the $91.3 million paid for Maple Crest Place ($252,000/unit, 5% cap) by Oneka Land Company Ltd. in June.

Industrial Sector

Investors continued taking a breather in the third quarter of 2024, collectively purchasing just 27 industrial properties for a total of $86 million. This brought year-to-date sales to 75 totalling $303.3 million – a year-over-year decrease of 22 sales and $266 million in dollar volume. No big-ticket transactions greater than $25 million had closed by September 30th. The largest sale of the year-to-date was the $24.8 million sale of the two-building complex at 11104 -180th Street.

Owner/Users accounted for more than 80% of year-to-date transactions and generated just under $171 million in sales. The largest transaction within this group was the $13.8 million purchase of 6005 - 72A Avenue ($236/ sf).

Retail Sector

Just under $53 million in transactions closed among retail assets during Q3, bringing total dollar volume at September 30 th to $202.7 million. This is down markedly from $372.8 million a year earlier and is attributable to the absence of transactions greater than $20 million closing by September 30 the .

Six transactions had closed above this threshold through Q3 2023 and two of those – the sales of Millwoods Town Centre & Millwoods Town Centre Professional Buildings ($69 million) and Namao South ($51.95 million) - accounted for nearly the entire year-over-year difference. As shown below, last year was a significant outlier for retail investment and the year-to-date 2024 is more in-line with a long-term average.

Commercial Condo Sector

Just under $88 million in transitions closed among commercial condominiums through September 30th , 2024 and $22 million of this transacted in Q3 alone. Year-to-date investment follows a five-year high set in 2023 and marks a return to the long-term average of just over $87 million. Total sales remained well above prepandemic levels and this suggests an ongoing desire among small business owners to also own their real estate. This appears to be borne-out in the resurgence of demand for retail condos, which comprised nearly one-third of year-to-date sales.

Speaking to prices per square foot, this metric decreased substantially to $300/sf for office condos from $341/ sf a year ago. Industrial condo prices per square foot prices remained quite stable, increasing by $2/sf to an average of $209/sf, while price per square foot values for retail condos posted a notable increase to $448/sf per square foot from $419/sf on a year-over-year basis.

Land Sector

By September 30th, 2024 the Edmonton market continued to experience a net decrease in both total transactions and dollar volume versus September 30th, 2023. This is despite a particularly busy third quarter in which 35 transactions closing for a total of $146.8 million. This three month period contained nearly half of total year-todate investment in the land asset class and set the stage for another strong year of land sales.

As one may surmise from the incredibly high multi-family property investment noted earlier in this report, land designated for multi-family and residential development led land sales, with 36 transactions closing. These totalled just under $75 million – approximately one-quarter of year-to-date total investment.

Market Synopsis and Predictions Summary

The third quarter of 2024 saw investment remain well above pre-pandemic levels, despite the overall softening seen in sales numbers and dollar volume at September 30th. Following a robust two-year period of unexpectedly strong sales activity and investment numbers, a pull-back was inevitable; it was just a matter of when. Given though, that both investment and sales remained well above mid-2019 levels, we still believe the larger picture suggests a sustained overall recovery. When we further take into account that most economic forecasts were projecting an economic downturn to emerge in late 2023 but the year finished at a six-year investment high, a period in which investors let some froth come off the market is not unexpected.

This sentiment extends to the Edmonton & area market commercial condominium market, which has developed significantly over the previous several years and drawn increasing sales activity and dollar volume on an almost consistent quarter-over-quarter basis since 2020. Even with the year-to-date decline in closed transactions, the return to long-term average was again line with general expectations. We continue to interpret this as a demonstration that the appeal of owning one’s real estate appears is holding strong in the Edmonton market.

More time and information are required to confidently announce a holding recovery in CRE investment. We are optimistic though, that with additional in-migration from other provinces and territories continuing to grow Edmonton’s population and with further Bank of Canada interest rate cuts expected this winter, the balance of 2024 will be strong

Prepared by The Network for the REALTORS Association of Edmonton

All opinions, estimates, data, and statistics furnished by other sources are believed to be reliable; however, we cannot guarantee their validity or accuracy. Visit www.networkalberta.ca for more info.